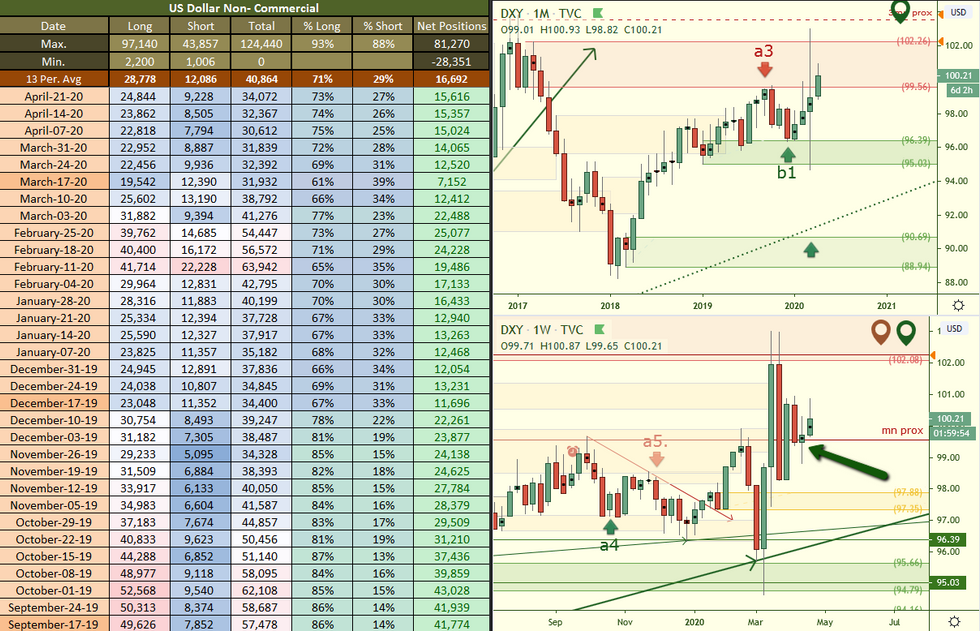

Based on the Commitments of Traders data reported on: April 21st 2020

📊 In the Markets: Gold is holding its own very well. In previous analysis we’ve determined that the higher timeframe trends were up and because of that we expected the latest monthly demand zone to hold and push price higher and this is what has taken place. So where do we go from here? Price is still making its way through some supply we have mapped out and it could take some time before it eats away through it all but there is a strong chance we see that take place. The COT data has shown us that they indeed took

some profits on long positions which would allow them to reload on their overall long position and cause a move higher.

As for #Oil, we outlined in last week’s report that we expected for price to continue downwards and it sure did drop. We saw oil drop from 18.44 down into minus prices. This was a first for oil and was due to contracts expiring and not enough storage space, at least this is the official story. We now have price building a foundation to slowly climb back upwards.

The #EURUSD is still playing out through many cycles from the monthly down to the daily. The main cycle is the monthly and we are watching it play out but our Sherlock analysis process has identified that price is playing out in such a way that it suggests more downside is about to take place. Still too early to be sure but early indications points to this.

🎩 Magic Trader!

🏫 White Oak University 👩🎓 Students 👨🎓 you can see the full report here: https://www.whiteoakfx.com/the-araujo-report

🚨🏆 Win a FREE month tuition paid by us by following us on Twitter @WhiteOakFX and Retweet our links and SHARE our YouTube videos to continue getting them for FREE!

👇📺🚨 Here was last weeks video provided to members 🚨📺👇

Video posted! https://youtu.be/UrxzNYgh7ww