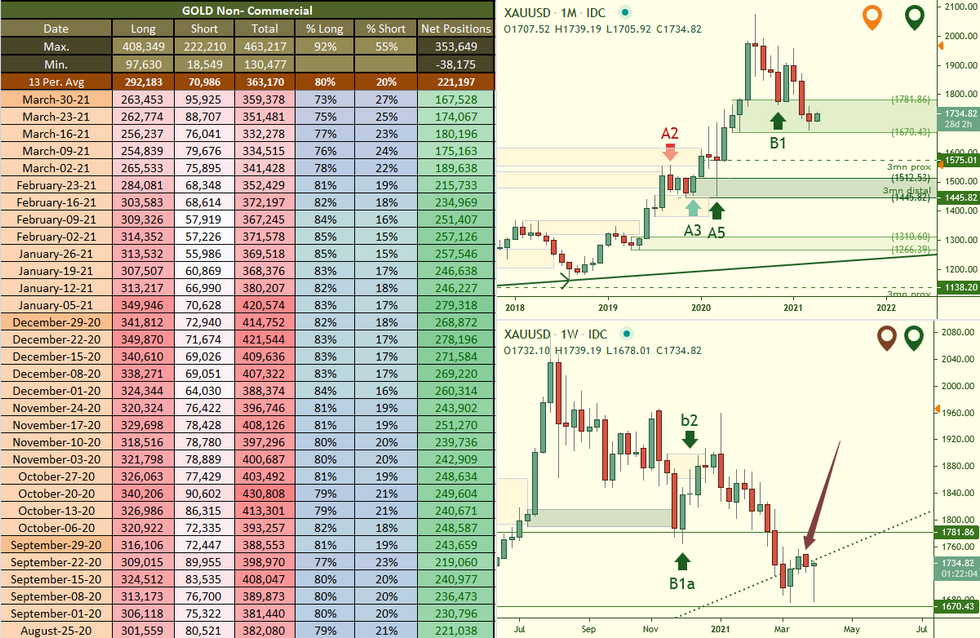

Based on the Commitments of Traders data reported on: March 30th 2021

#GOLD The descending trend line on the daily chart became invalid which now turns our head to the main trend line that we have on the charts. For momentum to start building upwards we would need to see the supply zones indicated to be removed as well as this trend line our focus of attention is currently on.

Monthly demand is still holding which is a good sign but looking at the 3 month chart we can see a bearish engulf was formed which typically means price will move the opposing bullish engulf or in this case the demand zone.

#USDOLLAR On the dollar chart we can see monthly supply is holding well and momentum

has shifted on the H4 chart. What we were watching for was to see if this supply would hold and if the #USDJPY or #USDCHF would rally to contact its supply. The #USDJPY has done just that and now we have 3 of the 4 dollar pairs within major supply. This builds up the argument that price should start to decline.

Dollar monthly supply holding well.

#USDJPY On the monthly chart of the USDJPY we can see that monthly supply has been contacted while the chart is ranging. This would lead us to suspect that price will start to decline.

#USDCHF on the other hand has not yet reached its monthly supply which is ok for now because the majority of dollar pairs have.

#OIL then we have oil and when we look at the 3 mn chart we can clearly see that we have an emotional candle that passed through the supply which tells us that this supply is still in play.

🚨🏆 Win a FREE month tuition paid by us by following us on Twitter @WhiteOakFX and Retweet our links and SHARE our YouTube videos to continue getting them for FREE!

Comments