🏦 Banks Moves 📈 Revealed on 📊 CFTC Spreadsheet

- White Oak University

- Sep 12, 2022

- 1 min read

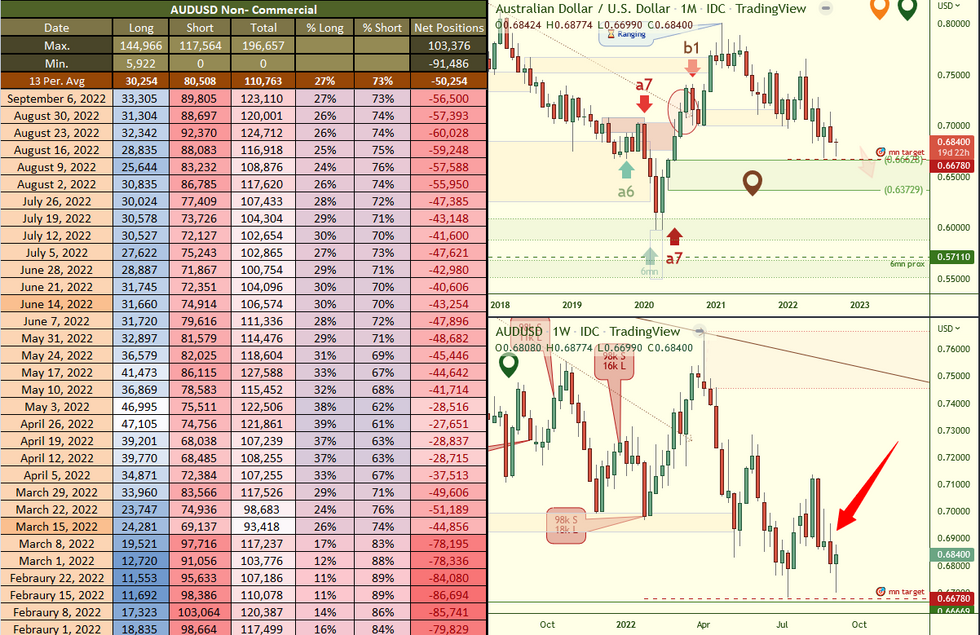

Based on the Commitments of Traders data reported on: September 6th 2022

#OIL weekly chart has removed two weekly demand zones, This opens the chart for a move lower when momentum picks up again. Weekly ascending trend line being contacted now. Likely retail is watching this contact and buying.

$EURUSD a significant breakout of the monthly range took place recently. This is very significant because we now have the charts opening up to allow a further decline if proper structures are built to the downside. The monthly may form a downtrend is we get a rally/base/drop with supply formed to support a further drop.

$BITCOIN Weekly demand came into play, a daily momentum shift was created and contacted for a short term move higher, it failed to proceed through to weekly supply and now has dropped from the weekly trend line, created daily supply and now has that supply in play. A lot going on here, could supply drop price… yes, but we also have weekly demand in play so there is no telling how the reaction will be. Watching for now. 🔴 Bearish bias ⏰longer term.

🚨🏆 Win a FREE month tuition paid by us by following us on Twitter @WhiteOakFX and Retweet our links and SHARE our YouTube videos to continue getting them for FREE!

👇📺🚨 Watch a PREVIEW of what students receive 🚨📺👇

Comentários