Banks trying to get traders to buy GOLD at highs

- White Oak University

- Jun 7, 2021

- 2 min read

Based on the Commitments of Traders data reported on: June 1st 2021

#GOLD contacted the daily supply zone we had mapped out and then price declined. I mentioned that there was going to be a moment when the banks would want to take profits n their long positions knowing that it was at a spot on the charts that traders would start getting in long. This is what took place when you examine the positions held by traders.

Price contacted supply and then we saw a nice decline form. This is what we’ve been expecting. Going in to the new week there is a good chance that a short/mid term move

lower will take place. Considering the retail is more long, the banks will likely try to get them to release those positions to them by driving price lower. This is what I am logically concluding by examining the positions and charts.

I also want to point out that there is a switch zone but I am not taking into consideration with the recent analysis as I don’t see reason to consider it at this time. Since there is a good chance that price will reverse from the daily demand zone lower on the charts – should price get down there – I will be looking for H4 momentum shifts off that area for early entry long. There will be risks involve in this entry as we must anticipate that the banks will drive price upwards from there without proof they want to create an uptrend.

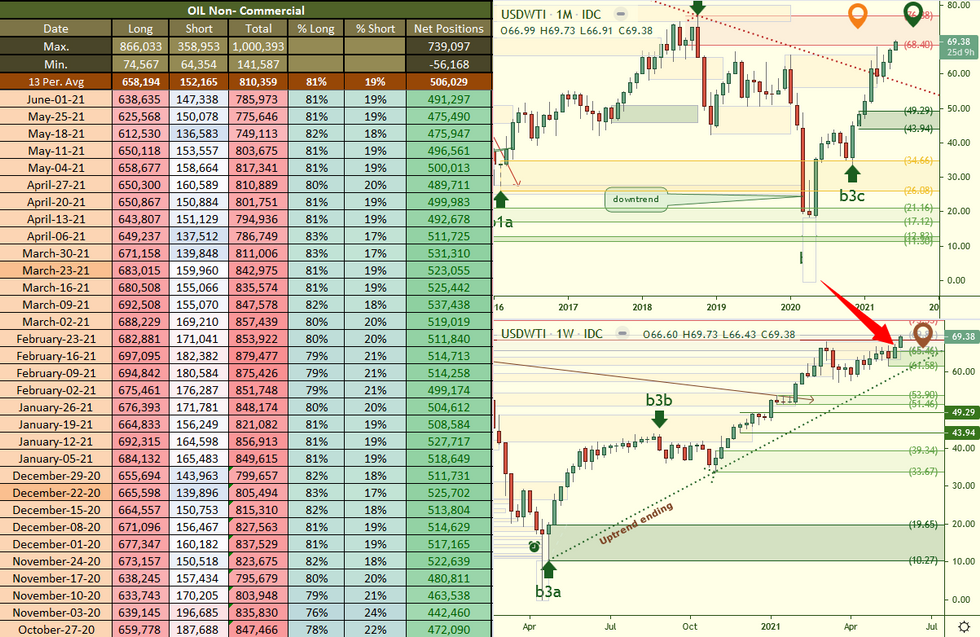

#OIL examining the 3 month chart we can see that price is very strong and is currently in consolidation which – based on what we know to be true about the markets – could provide us with a drop in price at any given moment but for the time being we are seeing supply being removed.

Currently we have the monthly supply coming into play but when I examine why this supply is supply, it leads me down a path of many switch zones which then makes we consider the legitimacy of the supply in question. I want to point this out because I will be considering this going forward as I continue to analyze this chart.

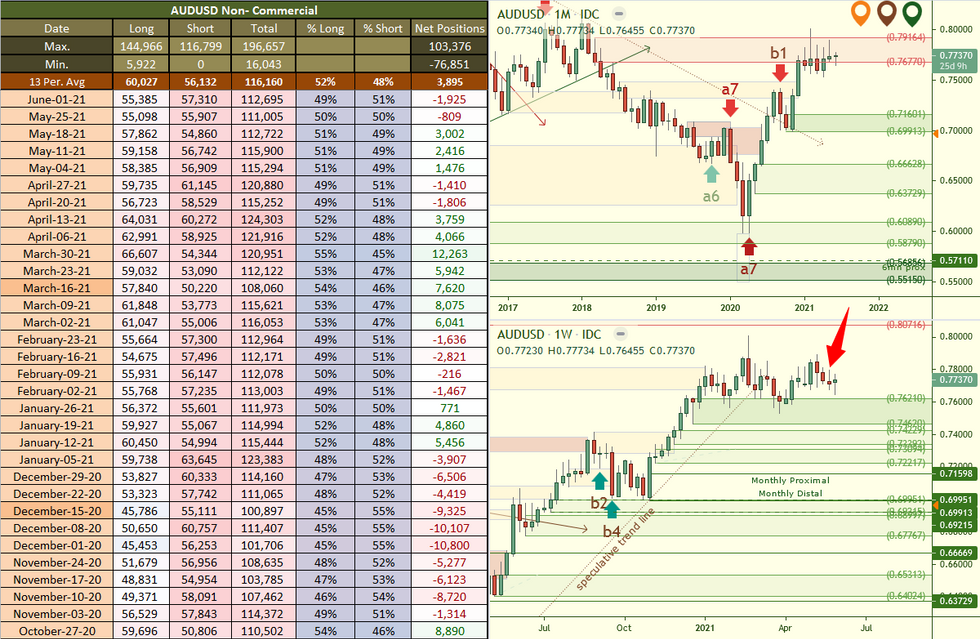

$EURUSD the daily uptrend is now broken and so therefore the chart signaled exiting out of long positions. There was a nice daily demand that price jumped up from which gave a great opportunity to exit long positions with small profit. No loss on positions.

Let’s keep in mind that the weekly chart is lacking momentum to the upside at this moment so now to engage in long positions waiting for a weekly zone to be contacted would be ideal.

🚨🏆 Win a FREE month tuition paid by us by following us on Twitter @WhiteOakFX and Retweet our links and SHARE our YouTube videos to continue getting them for FREE!

👇📺🚨 Watch a PREVIEW of what students receive 🚨📺👇

Comments