January 21st 2021 - Institutional 🏦 Positions & Supply/Demand for Gold, Oil and the FOREX market

- White Oak University

- Jan 21, 2021

- 2 min read

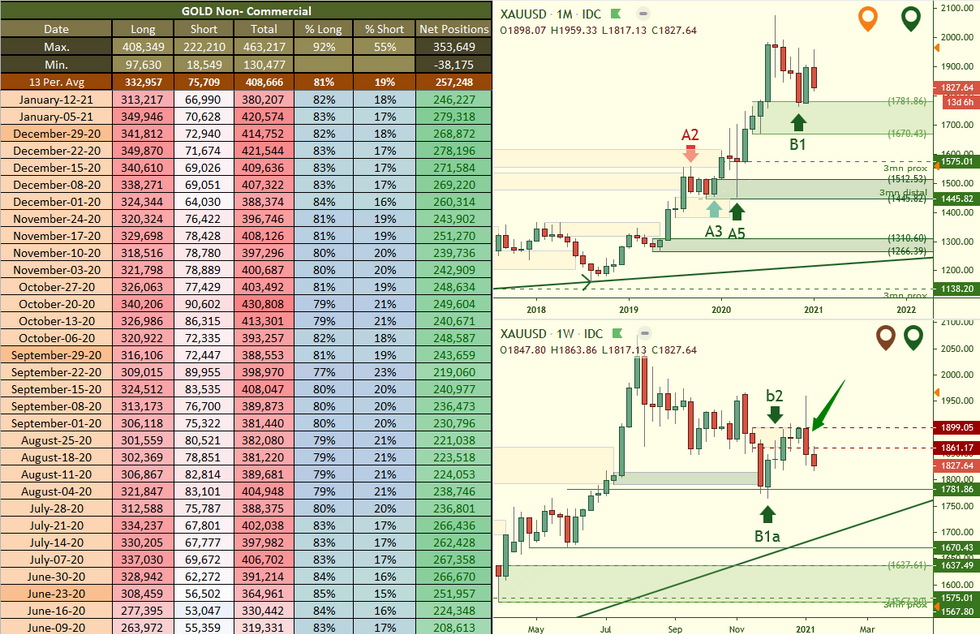

Based on the Commitments of Traders data reported on: January 12th 2021

We can see that #GOLD reacted from the monthly demand and removed the weekly supply but the move upwards was short lived. Now we see that daily demand is being removed and price is dropping. This tells us that we should be focused on the weekly chart for an understanding as to why price is doing what it’s doing. Daily supply needs to be removed for

more upside to take place. Will be watching for this in the coming weeks.

Now look at #OIL moving upwards exactly as we have been mentioning. The move took place perfectly as we had forecasted. Now we are seeing more highs towards the 54’s. There are higher timeframe cycles in play here which is why we knew price was going to rally like this. Once again the importance of knowing the cycles in play.

The #EURUSD contacted massive supply and the week ended off with a drop in price that was significant. The daily uptrend is over and now we will begin to see momentum shift to the downside. This is perfect for the short positions I have on my personal account. As for the #GBPUSD the weekly supply was taken out but no new demand formed which tells us this removal is likely to not hold for now.

The #USDCAD has got a clear path for a move lower and we are seeing evidence build of a possible rally short term so it could give some good opportunities to get in short again from higher up. Great week ahead in the markets!

🎩 Magic Trader!

🏫 White Oak University 👩🎓 Students 👨🎓 you can see the full report here: https://www.whiteoakfx.com/the-araujo-report

🚨🏆 Win a FREE month tuition paid by us by following us on Twitter @WhiteOakFX and Retweet our links and SHARE our YouTube videos to continue getting them for FREE!

👇📺🚨 Watch a PREVIEW of what students receive 🚨📺👇

Comments