March 12th 2019 - Institutional Positions & Supply and Demand for the FOREX market

- White Oak University

- Mar 12, 2019

- 2 min read

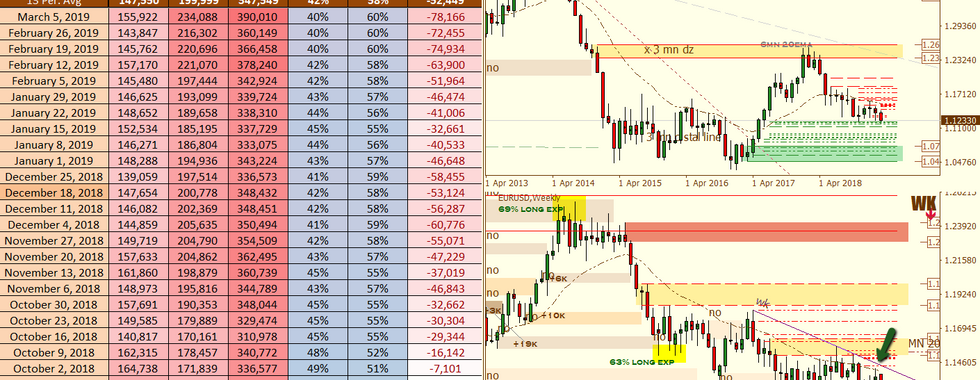

The positions below represent the institutional positions held as of March 5th 2019!

📊 In the Markets: The portfolio is looking strong and I am ready to continue adding. This week we saw #gold continue it’s reversal from within the Monthly supply zone. This is the move we’ve been waiting for and it took place this week. It also caused the removal of the daily demand that was keeping the ascending structure and trend in place. With that demand now removed it has caused a momentum shift to take place. This is the first step in the larger move lower we are expecting.

As for the $dxy #usdollar, we noticed some strength kick in, which is what we were anticipating and it was very evident in the $usdcad and the $usdjpy. The long trade signal on the $usdcad is playing out perfectly and in fact the bulletproof target has already been reached. It’s too bad I am not in that trade anymore but am reaping positive returns on my theme position. If these two pairs are any indication of what’s to come, we should see the $usdchf follow behind and make a run for it next week.

The $gbpusd and its cross pairs began to show some weakness after the dollar strength kicked in. Hard to determine what will happen with the pound but likely we see more strength in the future than weakness.

The $audusd and $nzdusd weakness was starting to come though, as we have covered in previous analysis videos. This downwards force should continue in the coming weeks.

Overall, the markets are starting to play out as we have been waiting for. Whether we see a break higher in the dollar this coming week or not remains the question. I think what we are seeing in the dollar pairs are a strong indication of this but the timing is what is not known. The analysis continues to prove itself of its accuracy and only becomes stronger as we add to our experiences from the markets.

👇📺🚨 Here was last weeks video provided to members 🚨📺👇

Comments