May 26th 2019 - Institutional 🏦 Positions & Supply/Demand for Gold, Oil and the FOREX market

- White Oak University

- May 26, 2019

- 2 min read

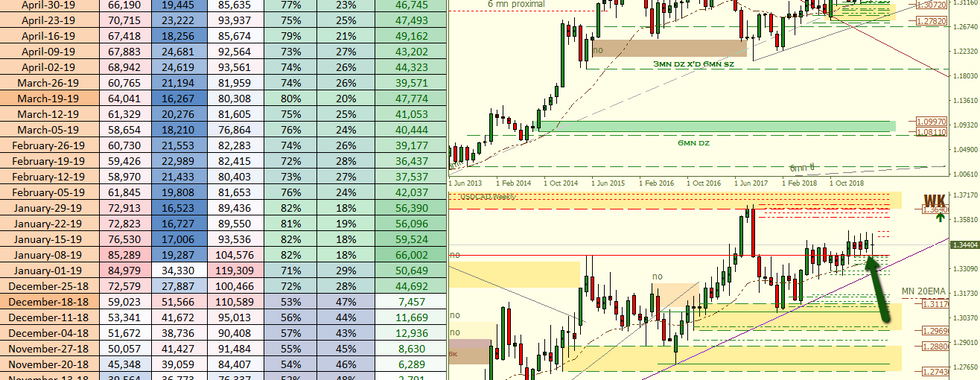

The positions below represent the institutional positions held as of May 21st 2019!

📊 In the Markets: Profit taking seems to be the theme that is in play in the markets right now. We spotted the need for this a few weeks back when we examined the positions of the institutions becoming too aggressive. Now we can see that the dollar pairs have begun some profit taking on their longs and a decline is price has followed. Looking at the #usdcad we can see that its price has been holding fairly well considering the drop we experienced in the #dollar. How far the #dollar will drop is the real question here. We currently have the weekly trend upwards and also the daily trend and it will be imperative for these trends to hold if we want to see a continuation of the move to the upside. Should they break they will create the opportunity for some short term move to the downside.

Looking at the #audusd and the #nzdusd we can see that they are both due for a nice pullback and relief from the aggressive short positions they hold. We can also see signs of a reversal begin to form on both the charts and the positions. But despite this need for profit taking, we must remember the higher timeframe forces that are still in play and although the retracements may present opportunity to open up positions, they all also present a certain degree of risk as these trades will be against the larger current that is in motion.

Taking a look at what took place with #gold over the last couple weeks we can see a blatant use of the daily descending trend line as a way to lure in retail shorts to enter and get stopped out while passing on their short positions over to the banks who gladly took them on in anticipation for the move lower. As for #oil we saw a massive drop in price and it is too bad that swaps had to be so darn expensive otherwise I would have been in some theme shorts on the portfolio to take advantage of the this move lower. On my personal account I took the risk and profited from the move but now I will be watching for the next opportunity to get in. I missed a great short trade signal that was difficult to spot but took place.

We are now waiting on the sidelines for some clarification from the markets. We need to see how long this profit taking will last and when they will resume the higher purpose. The $usdjpy will be a tricky chart to read as it will be moving against the dollars strength so will be watching this one closely and learning from its behavior. Very important to know when to engage in the markets and in our opinion, it is not now.

🎩 Magic Trader!

🏫 White Oak University 👩🎓 Students 👨🎓 you can see the full report here: https://www.whiteoakfx.com/the-araujo-report

👇📺🚨 Here was last weeks video provided to members 🚨📺👇

Comentarios