October 19th 2020 - Institutional 🏦 Positions & Supply/Demand for Gold, Oil and the FOREX market

- White Oak University

- Oct 19, 2020

- 2 min read

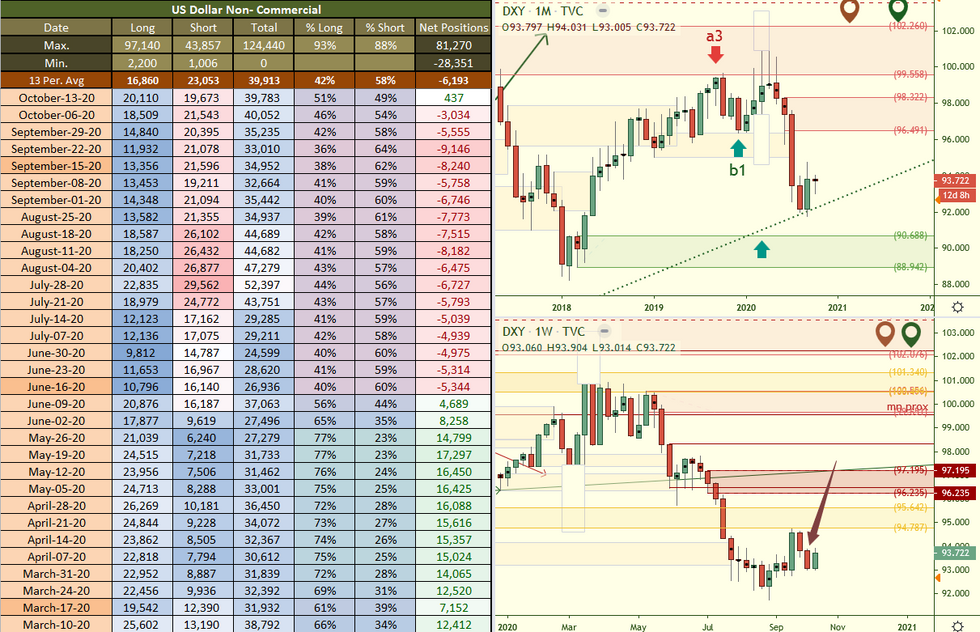

Based on the Commitments of Traders data reported on: October 13th 2020

📊 In the Markets: Many things are riding on what will take place with the #EURUSD in the next couple weeks. I sense in terms of timing a move can take place that soon. We’ve been watching this chart for some time now and it is very evident that what is likely to happen is a drop in price. Why do we feel this way? There are many things that stand out to me but the largest one is the fact that recently the institutions held an all-time record amount of long positions and when you already hold long, there isn’t much to do except to take profits

which will fuel a move lower. Looking back in 2018 the same thing took place. The only difference is there was something slightly different happening at that time and I am not considering the economic conditions, just focusing on what the #BANKERS were doing with price at that time and what they were setting up.

We also know that #GOLD is set to drop as well and this is a chart we’ve been waiting on. This chart is aligned with the #EURUSD and so with expectations of a drop, we can safely expect a drop on gold is coming as well. Gold on the other hand has a different dynamic in play on the charts and this chart can rip much higher once the momentum kicks in but I sense we’ll see a drop first.

The #USDCAD is also set for a major drop BUT we have to have that momentum kick in first and that hasn’t begun yet. We had the first stage of it take place when the weekly supply made contact but that has died down and now we are watching the daily chart for that one signal to be produced which will tell us that momentum may be kicking back up again.

🎩 Magic Trader!

🏫 White Oak University 👩🎓 Students 👨🎓 you can see the full report here: https://www.whiteoakfx.com/the-araujo-report

🚨🏆 Win a FREE month tuition paid by us by following us on Twitter @WhiteOakFX and Retweet our links and SHARE our YouTube videos to continue getting them for FREE!

👇📺🚨 Watch a FREE PREVIEW of what students receive 🚨📺👇

Comments