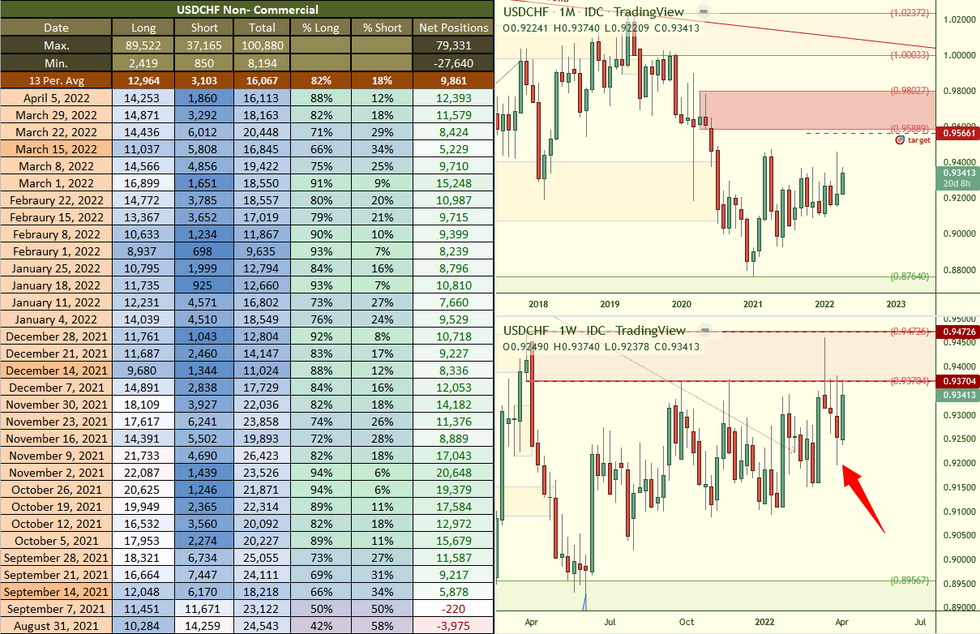

Based on the Commitments of Traders data reported on: April 5th 2022

$EURUSD the red supply zones has thicker distal and proximal lines indicating that this is the zone causing the major force, in this case to the downside. The demand zone within the range is lighter because with the current dynamic the bias is that this demand zone should be taken out. A signal that this demand will be removed with high odds is if price drops lower than the low made back in 2020.

#USD the weekly chart of the dollar has an uptrend, although not the highest quality trend the overall pressure is to the upside so the demand within this trend is darker as this zone is important and could be used to drive price higher should a drop in price occur.

$BITCOIN our forecast of price to the weekly supply played out to perfection. Now we have weekly supply pushing price downwards and the daily demand in uptrend broke through and price is dropping.

$SP500 move up to contact the weekly supply took place as we forecasted and the turn down has also played out as we suspected. I entered in some Put options to ride the momentum downwards and profit. Positions are closed for profits.

It’s important to note that the data is telling us that the banks used contract expirations to take major profits on their long position – which is what we’ve been saying – and sentiment is slightly bearish for the time being. Let’s see if more downside comes this week.

🚨🏆 Win a FREE month tuition paid by us by following us on Twitter @WhiteOakFX and Retweet our links and SHARE our YouTube videos to continue getting them for FREE!

👇📺🚨 Watch a PREVIEW of what students receive 🚨📺👇

Comments